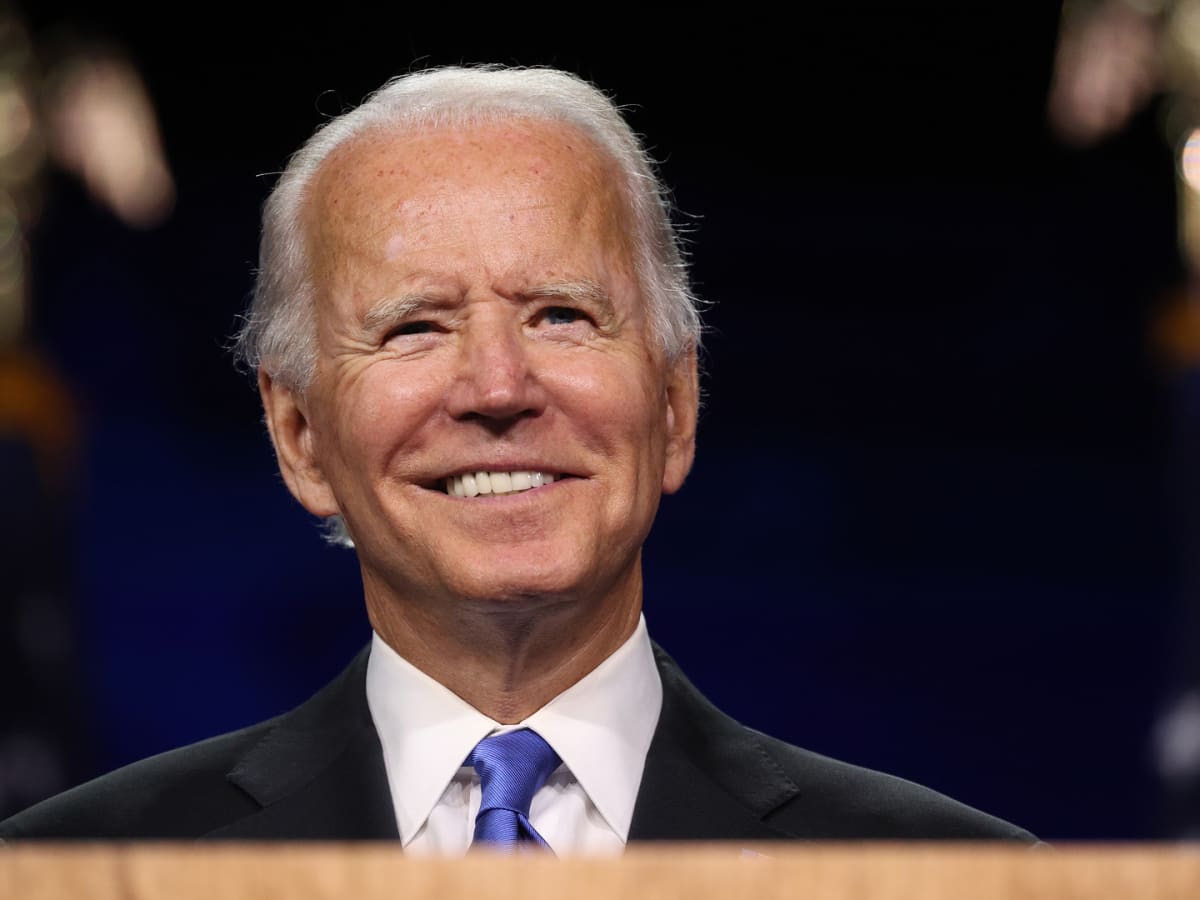

While on the campaign trail, then-presidential candidate Joe Biden presented a tax plan that promised to return the federal estate and gift tax exemption to its pre-Tax Cuts and Jobs Act (TCJA) amount of $5.85 million, and to increase capital gains taxes on upper-income individuals (among other provisions). Instead, when he announced the “American Families Plan” on April 28, 2021, he revealed a different tax strategy.

Instead of reducing the estate tax exemption, Biden aims to eliminate the automatic step-up-in-basis rule on unrealized capital gains in order to pay for the many provisions in his plan directed at helping families recover from the Covid-19 pandemic. This change in tactic will dramatically impact estate planning across the country. Under the proposed legislation, death would trigger unrealized capital gains and thus become an automatically taxable event. In response, affected individuals will want to update their financial and estate planning in order to avoid a major tax event when they die.

Preparing for Biden’s Tax Proposal

Under current legislation, when an individual inherits an asset that has grown in value since its original purchase, the base value upon which capital gains tax will be owned is stepped-up to the asset’s present fair market value. This means that if you inherit your parents’ home which they bought fifty years ago for $30,000 and is now worth $300,000, you need not worry about receiving a tax bill for the $270,00 in appreciated value. The Biden administration is proposing to rescind this automatic increase in the base value upon which capital gains tax is calculated thereby subjecting income gained from an asset’s increased value to taxation. This said the American Families Plan includes an exemption of $1 million for individuals and $2 million for married couples meaning only capital gains in excess of this amount would be impacted.

In addition to the provision eliminating the step-up-in-basis rule, President Biden would see earners in the top income bracket taxed at the pre-TCJA rate of 39.7% instead of the current 37%. Further, his proposal increases the tax rate on long-term capital gains increased to the ordinary income rate of 39.6% plus the 3.8% Medicare surtax.

Taken all together, though the American Families Plan has yet to pass Congress and remains a proposal, high-earning individuals, business owners, and those with large stock portfolios nevertheless have good reason for concern. In order to mitigate the potentially thunderous tax impact of this proposed legislation, such individuals will want to make a priority of sitting down with their financial advisor and an experienced estate planning attorney soon. Should Biden’s bill pass, donating appreciated securities, for instance, will become an even sharper tool for cutting down capital gains exposure. Likewise, gifting assets to shift exposure will gain newfound appeal as will saving in retirement accounts, among a range of many other strategies.

To learn more about how you, personally, can prepare for the Biden administration’s tax proposal or to address any other topic related to estate planning, do not hesitate to contact Caress Law either by calling (503) 292-8990 or using the contact form on our website.